Travel-Health Insurance for Students: UIC Sapphire Plans

October 9, 2024

October 9, 2024

Traveling is an exciting experience, whether for leisure, business, or education. However, unforeseen incidents such as medical emergencies, accidents, loss of baggage, or flight delays can disrupt your plans and leave you unprepared. This is where travel insurance becomes an essential part of any traveler’s itinerary. Having comprehensive coverage ensures peace of mind, knowing that you are financially secure even in a crisis.

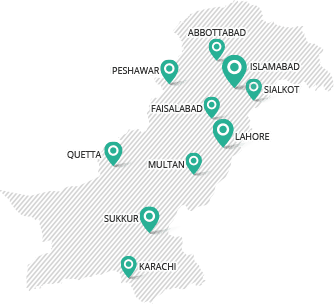

Among the top providers of travel insurance in Pakistan is The United Insurance Company of Pakistan Limited (UIC). With a prestigious AA+ rating by PACRA, UIC stands out as a reliable and trusted provider of travel insurance solutions, offering both affordability and extensive coverage to its clients.

Why Do You Need Travel Insurance?

Traveling brings with it a set of risks, whether medical or non-medical. The right travel insurance policy provides comprehensive protection to cover expenses like medical treatment, hospitalization abroad, loss of baggage, or flight delays. Especially when traveling to unfamiliar countries, having financial support for unforeseen incidents can be a lifesaver.

For students, especially those traveling for extended periods, travel insurance becomes even more critical. UIC offers student-specific plans designed to cover young travelers during their studies abroad.

UIC Travel Insurance Plans

UIC offers various travel insurance plans designed to cater to different needs. Here are two prominent plans offered under the Sapphire and Sapphire Plus student schemes:

Sapphire ($50,000 Coverage)

-

- 180 Days: PKR 14,950

- 365 Days: PKR 21,850

- 2 Years: PKR 42,550

Sapphire plus ($100,000 Coverage)

-

- 180 Days: PKR 20,125

- 365 Days: PKR 29,325

- 2 Years: PKR 56,925

These plans provide various durations of coverage at competitive prices, ensuring that students traveling abroad are financially protected for an extended period. Both plans include coverage for medical expenses, emergency medical evacuation, loss of baggage, and personal liability.

Key Benefits of UIC’s Travel Insurance Plans

UIC’s travel insurance plans provide comprehensive benefits aimed at covering both medical and non-medical risks. Here’s a closer look at the Schedule of Benefits under the Sapphire and Sapphire Plus plans:

Medical Expenses for Sickness & Hospitalization Abroad:

-

- Sapphire: $50,000 (Excess $150)

- Sapphire Plus: $100,000 (Excess $150)

Emergency Dental Care:

-

- Both plans offer $1,000 worth of coverage.

Repatriation of Mortal Remains & Transport in Case of Illness:

-

- Actual expenses are covered under both plans.

Loss of Passport:

-

- Coverage of $300 for both plans.

Accidental Death & Permanent Total Disability:

-

- 100% of the principal sum insured is provided for both plans in case of accidental death or total disability.

In addition to the standard coverage, UIC offers a range of value-added features such as:

- Transparent refund policies.

- Direct settlement of medical claims abroad.

- Personal liability cover and compensation for loss of baggage or passport.

- Free 24-hour medico-legal and language assistance services.

Exclusions to Be Aware Of

While UIC’s travel insurance offers extensive coverage, there are some exclusions that policyholders should be aware of:

- Pre-existing medical conditions are not covered.

- War or invasion, terrorism, and punitive damages fall outside the scope of the coverage.

These exclusions are important to keep in mind when purchasing any travel insurance policy, as they help manage expectations and ensure you understand what’s included and what’s not.

Buying Travel Insurance Online

UIC understands that ease and accessibility are important to today’s customers. Therefore, the company has introduced a hassle-free option to purchase travel insurance online. Travelers can buy insurance from anywhere at any time, making it incredibly convenient for those on the go.

This online facility has been designed with the client’s comfort in mind, ensuring that buying travel insurance is quick, easy, and reliable. Clients can now secure themselves for their trip in just a few clicks, without having to visit an office or go through complicated procedures. The insurance purchased online also adheres to the same high standards and offers the same benefits as plans bought through other means.

UIC’s Commitment to Transparency and Customer Care

UIC’s core focus is providing maximum coverage at affordable rates. Unlike some insurers, UIC prides itself on being fully transparent about its pricing, with no hidden charges or taxes. Additionally, UIC’s travel insurance plans are backed by European companies for re-insurance and assistance services, ensuring that clients have access to global support networks during their travels.

UIC also offers a premium refund policy, which is fully transparent and customer-friendly. The company’s commitment to transparency and customer satisfaction is one of the reasons it holds such a strong reputation in the insurance sector.

Conclusion: Let UIC Take Care of You

When it comes to ensuring a safe and secure trip, UIC’s travel insurance plans provide the coverage and peace of mind you need. Whether you’re a student traveling for studies or a leisure traveler, UIC offers robust protection, ensuring you’re covered no matter where you go. Don’t leave your journey to chance—let UIC, rated AA+ by PACRA, be your trusted travel insurance provider. Purchase your travel insurance online today and travel with confidence knowing you are covered by one of Pakistan’s top-rated insurers.