Education Insurance

The child education insurance is gives total coverage for child education expenses. In Pakistan 37% children are illiterate it shows that these children can’t get any opportunity to show their skills. Up and down is a part of life everyone should always be prepared for any type of emergency. The precautions for the secure future of a child is child education insurance. UIC provides flexible education insurance plans.

What we are Giving

Benefits

Vision behind the plan

Children are our future. We are not into this business just to make money; rather we have taken upon ourselves the responsibility of contributing to the welfare of our children. Many a time, our most talented children are left behind, often sidelined in the event of a mishap. We insure a child is not left behind for want of resources or become victim of an eventuality. Our Education Secure Plan is precisely tailor-made to protect future of our children.

- Comprehensive branded scheme offering value added features and complete solution for all education related worries.

- A vital tool in hassle free delivery of education care services; we will be there when you need someone to help.

- Offsetting of education expenses that have large bearing on education and its maintenance.

- Well-conceived and customized plan uniquely designed to address all education exigencies.

- Among very few national companies to cover around the world with direct settlement of medical expenses worth Rs 2.3 million abroad (Travel – Health Plan).

- Fulfills requirements envisioned in government policy of education for all.

- Insurance arrangements with world’s top re insurers

- Emergency Accidental medical cover for students during school time.

- Personal Accidental Death (PA) and Permanent Total Disability (PTD) cover for the Parents/Guardians.

- All Educational expenses i.e Exam Fee, Tuition Fee, Computer Fee, Sports and Lab Charges, Books, Uniforms etc. Upto Grade 10.

What’s Covered

Value Added features

Claim Settlement Procedure

You're just a tap away with our intuitive mobile app

Frequently Asked Questions

What is child education insurance?

Child education insurance provides comprehensive coverage for a child's educational expenses, ensuring financial support in case of any emergency, so children can continue their studies without interruption.

Why should I consider child education insurance?

Education insurance secures your child's future by covering educational costs, especially in case of unforeseen events such as accidents, illness, or the untimely death of a parent or guardian.

How does the UIC Education Secure Plan differ from other education insurance policies?

UIC’s plan offers a uniquely designed, comprehensive scheme with features like direct settlement of medical expenses worth Rs 2.3 million abroad and no additional taxes or charges.

Who is eligible for child education insurance?

The insurance covers students for accidental medical emergencies during school time and parents or guardians for personal accidental death or permanent total disability.

What are the additional benefits provided under the UIC Education Secure Plan?

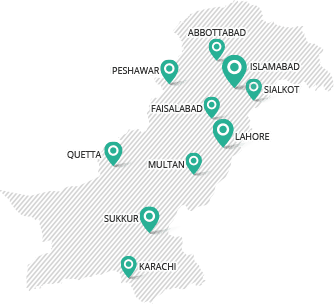

UIC provides value-added features such as branding advantages, discounts on other UIC products for parents, and nationwide branch networks ensuring extensive coverage.

How can I file a claim under the child education insurance plan?

Claims can be filed by submitting a simple, easy-to-fill Performa endorsed by the school management, along with original prescription bills, receipts, and other supporting documents.

What is the deadline to submit claims for educational expenses?

All claims must be submitted within two weeks of the expense or event.

Does UIC offer direct settlement with hospitals for medical expenses?

Yes, UIC provides direct settlement of claims with its panel hospitals, making the claim process hassle-free.

What documents are required to submit a claim?

You need to submit original bills, prescriptions, receipts, and a Performa endorsed by the school management.

What is the process for settling claims if I do not use a panel hospital?

If you use a non-panel hospital, claims can still be settled by submitting the required documents to UIC for reimbursement.

What educational expenses are covered under the plan?

The plan covers various educational expenses including exam fees, tuition fees, computer fees, sports and lab charges, books, and uniforms up to Grade 10.

Are parents or guardians covered under the plan?

Yes, parents/guardians are covered for accidental death and permanent total disability under this education insurance plan.

Does the insurance cover medical emergencies during school hours?

Yes, students are covered for emergency accidental medical expenses incurred during school time.

What is the maximum medical coverage provided abroad?

UIC offers coverage for medical expenses up to Rs 2.3 million abroad as part of its travel and health plan.

Does the insurance plan cover international educational expenses?

While the plan covers medical expenses abroad, its focus is primarily on covering domestic educational costs like tuition and exam fees.

How do I renew my child’s education insurance policy?

The policy can be renewed by contacting UIC or visiting a nearby branch before the expiration date to ensure continuous coverage.

Is there any discount on premium during renewal?

UIC offers special discounts on its product line for parents, which could apply when renewing the education insurance policy.

What happens if I miss the renewal deadline?

If you miss the renewal deadline, there could be a lapse in coverage, which might affect your ability to file claims for any expenses incurred during the lapse period.

Can I make changes to the policy during renewal?

Yes, you can review and adjust the coverage or add additional benefits during the renewal process based on your requirements.

Will the renewal process involve any additional fees or taxes?

No, UIC’s education insurance plan does not charge any additional taxes or fees during renewal.

RECENT NEWS FEED