Commercial Vehicle Insurance

The United Insurance Company of Pakistan Limited (UIC) provides you the best insurance services in town. Commercial vehicles are the most affected vehicle on the road and have to face losses. So, UIC commercial vehicle insurance online make you secure in just few easy and simple steps. Buy online commercial vehicle insurance and protect your vehicle and also relief yourself from third party loss.

What we are Giving

11005

Total No. of Policies

216 Million+

Premium

44 Million+

Total Claims

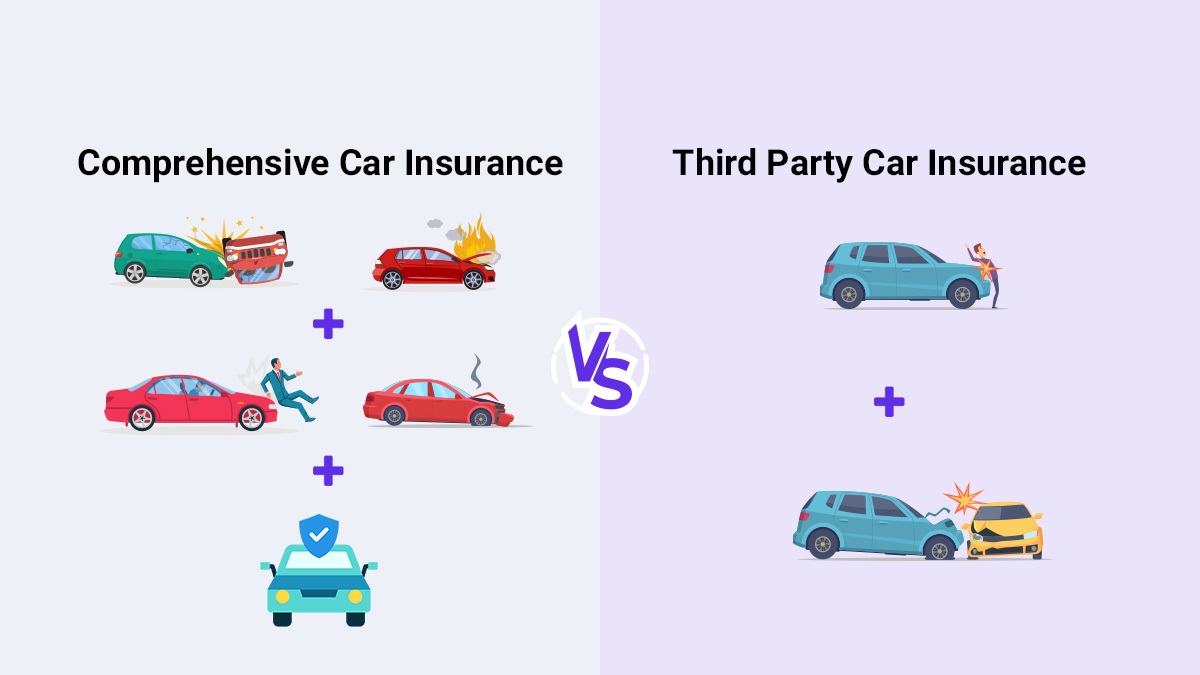

The Insured shall be indemnified against loss of or damage to the Motor car and / or its accessories whilst thereon by:

- Accidental external means

- Fire, External explosion, self-ignition or lightning or frost

- Burglary, house-breaking or theft

- Malicious act

- Riot, strike

- Flood, hail, wind, hurricane, cyclone, tornado or typhoon

- Earthquake, volcanic eruption or other convulsion of nature

- Whilst in transit by air, road, rail, inland waterway, lift or elevator

- Death or bodily injury to a third party (except for the person employed by the insured)

- Damage to property of a third party (except for the property held in trust or custody by the insured of a third party)

- The driver who is driving the motor car on the insured’s order / permission, shall be duly indemnified provided that such driver is not entitled to any other insurance policy.

- Indemnity to the insured even when he is driving a vehicle not belonging to him and not hired by him under a hire purchase agreement

- In case of death of a third party, the company will indemnify the deceased’s personal representatives in the terms of and subject to the limitations of the policy.

Medical Expenses

- Pre inspection of vehicle is mandatory

- Damages found at the time of pre-inspection are not covered.

- Loss intimation should be conveyed to Insurance Company after the loss.

- Intimation is required for cancellation of policy by the company or the insured with return of premium on pro rata basis.

- This policy is for social domestic and pleasure purposes and for the insured’s business only.

You're just a tap away with our intuitive mobile app

What’s Covered

No payment will be made in respect of:

- Under the CV-4 clause on commercial vehicle. Insurance Company will not be liable for any loss or damage occurred to Lamps, tyres, mud guard, bumper and paint work.

- Any loss damage sustain or incurred outside the geographical area of Pakistan.

- Any loss or damage sustain or incurred from any consequential loss.

- Any loss or damage sustain or incurred by a person other than the driver as described in the policy.

- Any loss or damage sustain or incurred by nuclear weapon, fuel or waste material.

- Depreciation and wear and tear.

- Any loss or damage sustain or incurred by mechanical or electrical breakdown, failure or breakage.

- Damage to tyres and battery unless the motor car is damaged at the same time when the coverage is limited to 50% of the cost of such replacement.

- Any loss or damage sustain or incurred after termination of ownership.

- For more detail on exclusions refer to policy wording

| Net Premium: | 1.8% of Market Value |

| Vehicle Age: | Up to 5 Years |

| Maximum Sum Insured: | 3 Million |

| Vehicle Type: | Commercial |

| Non-Filer Tax: | A charge of 4% additional withholding tax on non-filers |

| CV-4 Clause: | Under the CV-4 clause on commercial vehicle. Insurance Company will not be liable for any loss or damage occurred to Lamps, tyres, mudguard, bumper and paint work. |

Frequently Asked Questions

What is commercial vehicle insurance?

Commercial vehicle insurance is a type of insurance policy that covers vehicles used for business purposes, offering protection against damage, theft, and third-party liability.

How can I purchase commercial vehicle insurance from The United Insurance Company (UIC)?

You can easily buy UIC commercial vehicle insurance online through a few simple steps on their website.

What types of vehicles are eligible for UIC’s commercial vehicle insurance?

UIC's commercial vehicle insurance is available for vehicles used for business purposes, with a maximum vehicle age of 5 years and a sum insured up to 3 million PKR.

Is there an additional tax for non-filers when purchasing UIC’s commercial vehicle insurance?

Yes, non-filers are subject to an additional 4% withholding tax.

Does UIC’s commercial vehicle insurance cover damages outside Pakistan?

No, the insurance only covers losses or damages that occur within the geographical boundaries of Pakistan.

How do I report a claim for a commercial vehicle?

Loss intimation should be conveyed to the Insurance Company immediately after the loss.

Are pre-existing damages covered under the insurance policy?

No, any damages found during the pre-inspection of the vehicle are not covered.

What is covered under third-party liability claims?

UIC covers death or bodily injury to a third party and damage to third-party property, excluding property held in trust by the insured.

What is the process if a third party dies in an accident involving my insured vehicle?

UIC will indemnify the deceased's personal representatives according to the terms and limitations of the policy.

Are medical expenses included in the coverage?

Yes, UIC will cover medical expenses up to Rs. 500 for any accidental bodily injury.

What risks are covered under Section 1: Loss or Damage?

Coverage includes accidents, fire, theft, natural disasters (like floods and earthquakes), and transit damage.

What is not covered under the CV-4 clause?

UIC does not cover damage to lamps, tyres, mudguards, bumpers, and paintwork under the CV-4 clause.

Does the policy cover damage to the vehicle’s battery and tyres?

Yes, but only if the motor car is damaged at the same time, and the coverage is limited to 50% of the replacement cost.

Is theft covered under UIC’s commercial vehicle insurance?

Yes, theft, including burglary and house-breaking, is covered under Section 1.

Does UIC cover damages due to natural disasters?

Yes, the policy covers damages caused by floods, hurricanes, cyclones, earthquakes, and other convulsions of nature.

How do I renew my commercial vehicle insurance policy?

You can renew your policy online through UIC’s website or contact their customer service for assistance.

Is a pre-inspection required at the time of policy renewal?

A pre-inspection may be required to assess the current condition of your vehicle before the renewal is approved.

What happens if I do not renew my policy before it expires?

If your policy expires, you will not be covered for any damages or third-party liabilities until the policy is renewed.

Can I cancel my policy mid-term and get a refund?

Yes, you can cancel the policy, and a pro-rata refund will be issued for the remaining period.

Will my premium change upon renewal?

Your premium may change based on the current market value of your vehicle, claims history, and other risk factors.

RECENT NEWS FEED