What we are Giving

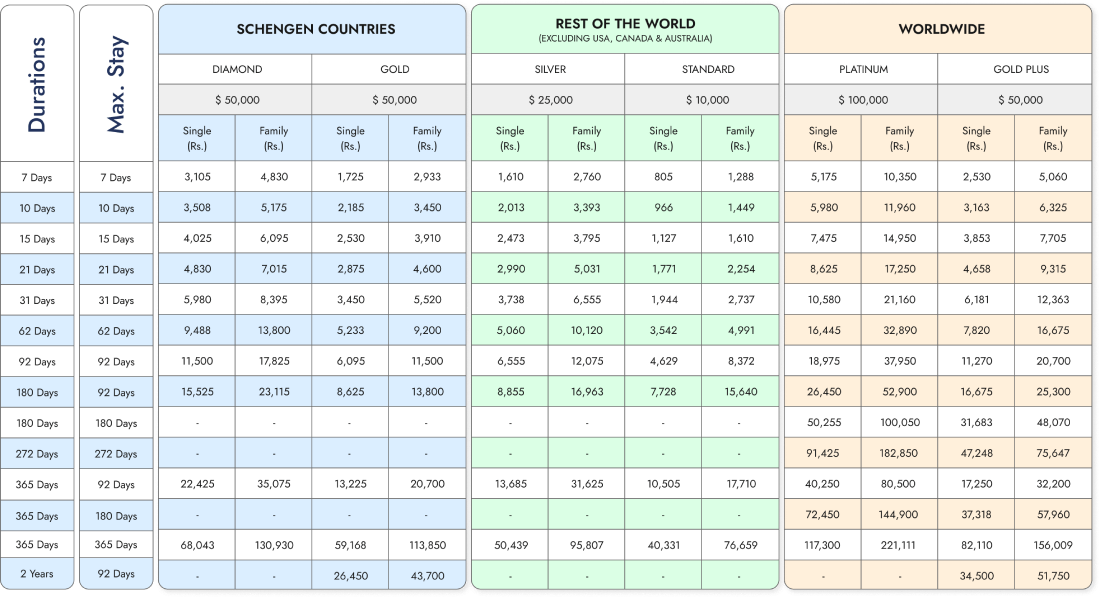

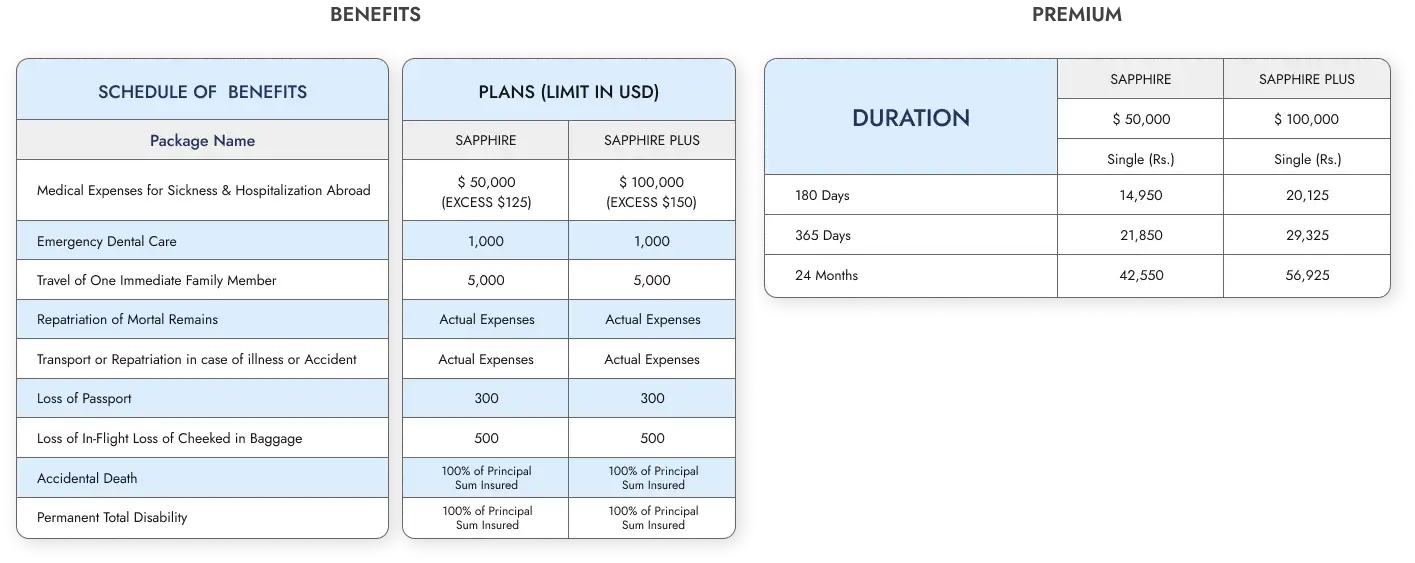

Worldwide

Schengen Countries

Rest of World

108,140

Total No. of Policies

521 Million+

Premium

10 Million+

Total Claims

Benefits of Choosing United Insurance

As a national insurer with a top-tier rating, UIC guarantees:

- Maximum coverage at competitive prices.

- No hidden charges or taxes.

- Support from European companies for reinsurance and assistance services.

- A transparent premium refund policy.

- This service at your doorstep with a nationwide network of over 150+ branches. is the list item

UIC ensures comprehensive support, making it the ideal choice for travelers seeking reliable and hassle-free travel insurance.

- Transparent refund policy.

- Age Limit – 90 years. (Travelers up to 65 years of age are eligible without additional premium).

- Direct settlement of medical claims abroad.

- Loss of baggage & passport, Flight delay & personal liability cover.

- Free 24 hour medico-legal & language assistance.

What's Covered

Exclusions

- Pre-Existing medical conditions.

- War, Invasion/terrorism.

- Fire Penalties/ punitive damages.

- For more detail on exclusions refer to policy wording.

Compensation of COVID-19

- Post-Treatment Screening/Test taken in abroad is only covered when /if resulted Positive.

- Self-quarantine/ quarantine in Private Hotels or Hospitals or at home is not covered under the said policy terms & condition.

- S $100 deductible on loss arising from COVID-19.

- Follow-up treatment is only covered when/if a followed up test is Positive and prescribed by a medical practitioner of recognized hospital.

- In Case the Insured Person tested positive with COVID-19 during a trip covered, the Insurance Cover only medical Expenses & Hospitalization Abroad.

- All claims related to COVID-19 will only be considered after the submission of Negative test report undertaken within 96 hours before travel.

- All claims related to COVID-19 will be settled on Re-imbursement basis in PKR only.

- Maximum Insured’s age 70 years to obtain COVID-19 Coverage.

Travel Insurance Insurance is now just a tap away with our intuitive mobile app

Frequently Asked Questions

What is travel insurance?

Travel insurance provides financial protection against unexpected events during your trip, such as medical emergencies, trip cancellations, lost luggage, and more.

Why do I need travel insurance?

Travel insurance is essential for covering unexpected costs, such as medical emergencies or trip cancellations, ensuring that your trip is financially protected.

Is travel insurance mandatory for all international travel?

While not required for all destinations, travel insurance is mandatory for Schengen countries and several others like Turkey and Ukraine. It's also highly recommended for all international travel.

What does travel insurance typically cover?

Travel insurance usually covers medical emergencies, trip cancellations, lost luggage, and travel delays, depending on the policy.

How do I choose the right travel insurance plan?

Consider factors such as your destination, trip duration, and personal needs. Our team can help you select the best plan for your travels.

How do I file a claim if something goes wrong during my trip?

To file a claim, contact our claims department using the contact details provided on your policy, and submit the required documentation.

What documents are needed to make a travel insurance claim?

You'll typically need your travel insurance policy, proof of the incident (e.g., medical reports, police reports), and receipts for expenses incurred.

How long does it take to process a travel insurance claim?

Claims are usually processed within 30 days of receiving all necessary documentation.

What should I do in case of a medical emergency abroad?

Contact the emergency numbers listed on your travel insurance policy for immediate assistance and guidance on seeking medical care.

Can I track the status of my travel insurance claim?

Yes, you can track your claim status through our customer portal or by contacting our claims department.

What does United Insurance’s travel insurance cover?

Our travel insurance covers medical emergencies, trip cancellations, lost or delayed luggage, and other unexpected events during your trip.

Are pre-existing medical conditions covered?

No, pre-existing medical conditions are typically not covered under travel insurance policies.

Does your travel insurance cover adventure sports?

Coverage for adventure sports may be included or available as an add-on, depending on the policy. Check your policy details for specific coverage.

What happens if I lose my passport during my trip?

Our travel insurance can cover the costs associated with obtaining a new passport if it's lost during your trip.

Is coverage available for trip cancellations due to COVID-19?

Some of our travel insurance policies may offer coverage for trip cancellations due to COVID-19. Please check the specific terms and conditions.

Can I renew my travel insurance policy if I extend my trip?

Yes, you can renew or extend your travel insurance policy if your trip duration increases, as long as it's done before the original policy expires.

How do I renew my travel insurance policy?

You can renew your policy online, by phone, or by visiting one of our offices before your current policy expires.

Is there a grace period for renewing travel insurance?

There is no grace period for travel insurance. It must be renewed before the policy expiration date to ensure continuous coverage.

What happens if I don’t renew my travel insurance?

If you don’t renew your travel insurance, your coverage will lapse, leaving you unprotected during your travels.

Can I update my policy details when renewing?

Yes, you can update your coverage options, travel dates, and other details when renewing your policy.

RECENT NEWS FEED

Latest news & articles from

the blog